Article

Addressing Early Shopping Trends: Insights from Sensormatic Solutions 2024 Holiday Survey

All signs point to a positive, profitable holiday shopping season this year. McKinsey & Company’s latest consumer optimism research shows that America’s shoppers feel more positive about their financial futures than they have been at any other time this year. According to the data, they’re ready and willing to spend more for holiday 2024.

Our annual Holiday Consumer Sentiment survey, which asked American shoppers to share details about their intentions ahead of the winter holidays, echoed the research firm’s findings. Nearly half (48%) of respondents said they plan to spend more this holiday season than they did last year, and just over a quarter (28%) say that their personal financial situation will not impact changes in their spending in any way. Again, this year clothing and apparel (60%); electronics (51%); and toys, books and other media (45%) are expected to be the season’s top sellers.

But other factors will impact their choices this holiday season. Here’s what we found:

Consumers plan to shop early when they can

Traditionally, the holiday shopping season begins on Black Friday (the day after Thanksgiving), and American shoppers will be out in droves on Nov. 29. Of those who said they intend to shop after having their holiday meals, 42% said they would do so in 2024, compared to only 26% in 2022.

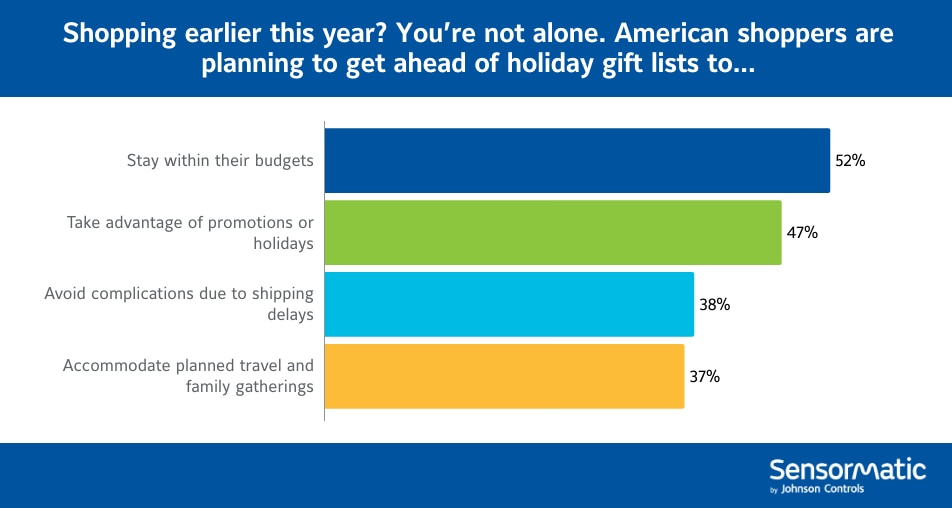

Of note, though, the past few years have seen gift-buying creep earlier and earlier into the months prior. This year, that trend will continue as 54% of respondents said they will start their holiday shopping before November, and 52% of shoppers plan to start their holiday shopping earlier than they did last year.

Demographics also have a role to play in these decisions as there were distinct differences among shoppers of different age groups. Shoppers aged 45-60 are most likely to start their shopping early (65%), followed those aged 30-44 (57%), those 18-29 (45%) and those over 60 (28%).

Retailers should keep in mind, though, that Thanksgiving falls relatively late in the month of November this year (Nov. 29), leaving just 27 days between Black Friday and Christmas Eve. That means fewer days to shop, which means stores are likely to see larger crowds during peak hours than they might have in the past.

Quality experiences and convenience remain top factors in shopper decisions

Though many respondents shared that they still planned to do some shopping online this year, the unique experiential benefits of in-store shopping have them planning to head into physical retail locations. Shoppers planning to head into stores say that they will do so because it allows them to browse for gift ideas (34%) and see products in person before buying (26%)—two things online sellers cannot match.

Current research also suggests that the widespread perception that online shopping has an edge on convenience may also be breaking down. Just 43% of shoppers say they find online shopping somewhat or much more convenient than in-store visits. In our survey, the number of respondents who said they plan to buy gifts online for home delivery has dropped more than 10 percentage points since 2022, falling to 65% from 77% two years ago.

Brick-and-mortar retailers have an opportunity to remind shoppers that in-store visits have their own convenience perks, too: no waiting on delayed shipments, no quality surprises and readily available customer service representatives who are eager to help. Shoppers looking for the best of both worlds this year continue to favor omnichannel fulfillment options like curbside and in-store pickup, and more than three-quarters (77%) of survey respondents said they plan to use these programs where available.

To ensure things run smoothly, retailers may benefit from focusing on improvements to the key shopper journey pain points shared by survey respondents:

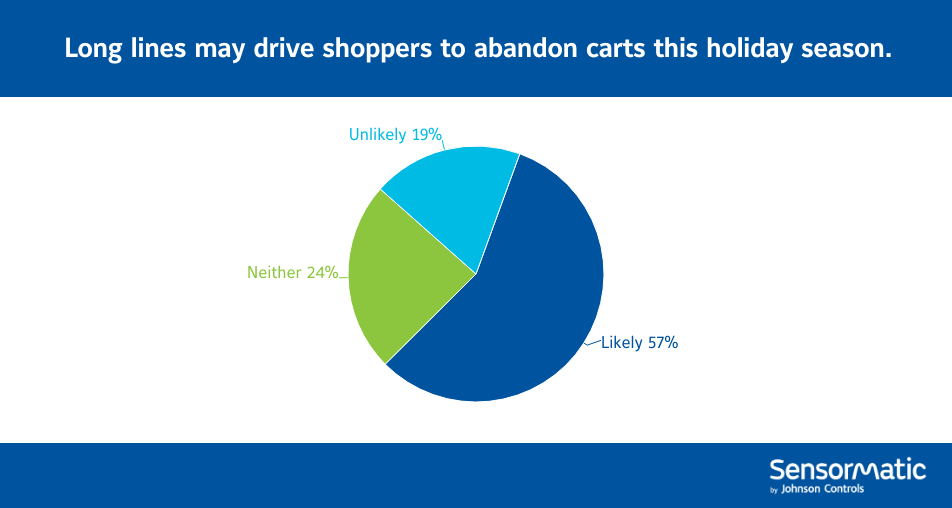

- Crowds/long checkout lines (53%)

- Out-of-stocks (46%)

- Long waits for curbside/in-store pickup orders (29%)

Long checkout lines, in particular, may have an outsized impact on not just experience but sales. Over half (57%) of shoppers say they are at least moderately likely to abandon their shopping cart in-store this holiday season when faced with long checkout lines. Focusing on staff training and labor allocation may also be beneficial, as nearly half (47%) of consumers say they interact with store associates every time they shop in person. More than one-third (34%) of consumers say that associates are their first stop when items are out of stock. Omnichannel program improvements should also be top of mind as we head into the holiday season’s tail end, as shipping deadlines and dwindling online product availability may lead shoppers to turn in in-store fulfillment options.

Sustainable brands will have an edge

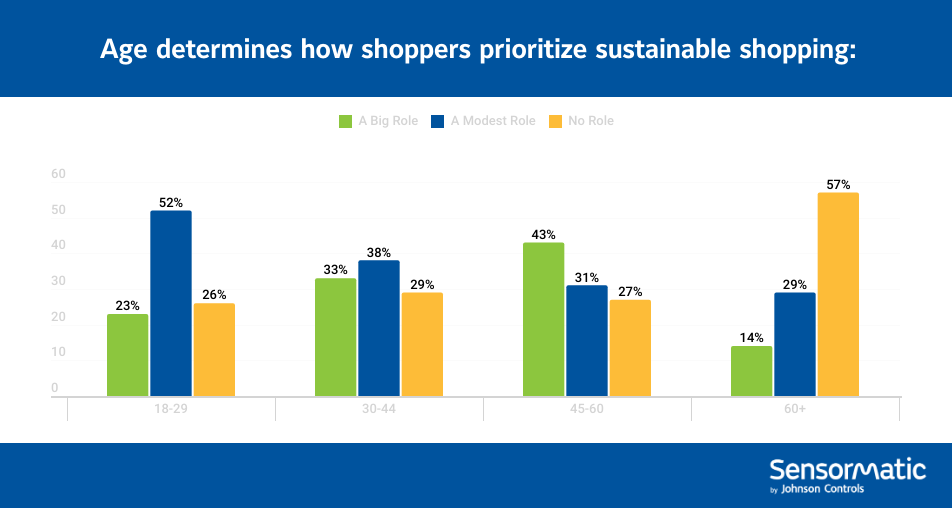

Sustainability’s impact on shopping choices has been growing steadily over the last few years, and it will continue to play a prominent role in purchasing decisions. Nearly one-third (31%) of respondents noted that they only shop at stores with sustainability initiatives and eco-friendly practices, and slightly more (36%) said they try their best to shop at stores that embrace these efforts.

Shoppers’ ages are strongly correlated to their desire for sustainable products, with 45-to 60-year-olds (43%) the most likely to say sustainability practices will play a big role in their choices. Shoppers between 30 and 44 (33%) follow closely behind, and 18-to-29-year-olds (23%) and shoppers over 60 (14%) are less concerned about retailers’ sustainability practices. However, 18-to-29-year-olds are the least likely to say that sustainability plays no role at all (26%).

Visible security measures are good for everyone

Retail’s push toward connected stores led many to believe that hard tags, locked cases and other physical security measures would be replaced with new, more discrete theft-prevention solutions. While this is somewhat true, rising concerns about in-store safety amid a spike in organized retail crime (ORC) have helped cement loss prevention hardware’s place in modern stores. And that’s not just true for retailers; our Back-to-School Survey found that shoppers share an appreciation for visible and present security solutions.

More than two-thirds (69%) of all respondents shared that visible security measures make them feel safe and comfortable in retail locations, and one-third (34%) of those who hold this belief said they only feel safe in stores where they see a commitment to security. Shoppers cited security personnel (guards; 54%), surveillance cameras (51%) and electronic article surveillance (EAS) tags (28%) as the visual deterrents most likely to make them feel safe and protected within retail locations.

Key Takeaways

Though the holidays are inching closer, there’s still plenty of time for retailers to let data lead in the last months of the year. These findings—along with enterprise-, region- and location-specific shopper behavior insights from retailers’ connected systems—highlight where shoppers’ minds are as we dive into the holiday rush.

To learn more about how shopper data can inform more satisfying holiday experiences, visit www.sensormatic.com/shopper-insights. For more Sensormatic Solutions holiday insights, use #SensormaticHolidays to follow along on LinkedIn and X.

Explore Related Topics