Article

Traffic, Inventory, and Sales Trends to Watch for This Easter

As Easter approaches, what can retailers expect from the busiest shopping day of spring?

Easter is the make-or-break event of the first half of the year and marks the peak of springtime shopping. This upcoming Easter holiday will be the first in years to have pre-pandemic potential in terms of traffic and revenue. For retailers, this is great news — and there are plenty of reasons for them to be optimistic.

First is the sheer number of Americans who celebrate the holiday. According to the National Retail Federation, 80% of Americans celebrate Easter in some form or another. Meanwhile, even though consumers expect to spend marginally less than they did during the last two years, they still plan to spend more during this Easter than they did in 2019 — an increase of almost $3 billion.

But what will foot traffic look like? And how should retailers prepare the weeks immediately after the holiday?

Almost back to normal?

"As we get further away from pandemic restrictions and mandates, people clearly feel more open and comfortable about gathering," said Pete McCall, senior manager, retail consulting practice at Sensormatic Solutions. "This level of comfort is really the defining factor for every trend we expect to see this Easter. It's going to determine the categories that sell well in the lead up to the holiday, how much people are willing to spend, and the amount of in-store traffic retailers can expect."

Why? Because, he noted, larger groups and more in-home gatherings among family and friends will fundamentally change the dynamic retailers saw during the past two Easters.

"During the height of the pandemic, people were having smaller gatherings for Easter for obvious reasons," McCall said. "Smaller gatherings mean more gatherings — rather than larger, extended family events. As a result, spending on things like home goods and cookware rose during the previous two Easters, while categories like apparel didn't get their typical Easter boost because if you're around only immediate family, there's less of an impetus to dress up."

This year, however, McCall noted that retailers can expect something of a return to pre-pandemic norms in terms of typical Easter sales leaders.

"That means a major boost to apparel and accessories, above all," he said. "If you're gathering with extended family or a large friend group for what may be the first time in two years, you're going to want to look your best."

He also expected home goods to be popular, albeit somewhat less so than during the pandemic.

"If I'm going to a big potluck Easter celebration, I've only got to bring a dish or two, whereas if I'm doing the entire celebration in my home with only my family, I've got to have multiple dishes, utensils, place settings, etc.," he noted. "I expect home goods will be strong sellers per usual, though perhaps not quite as strong as they were during the two most recent Easter holidays."

Meanwhile, gift-giving — traditionally a major driver of Easter sales — is expected to remain as prominent as ever, meaning items like toys and seasonal candy likely will sell well per usual.

What do these factors mean for retailers?

"I would put my energy into the apparel category first and foremost, and make sure that I've got traditional spring goods up front and visible," McCall said. "I would make sure they were well merchandised, well replenished, and that our inventory of spring goods is prepared for strong sales."

Prepare inventories and associates for a traffic boost

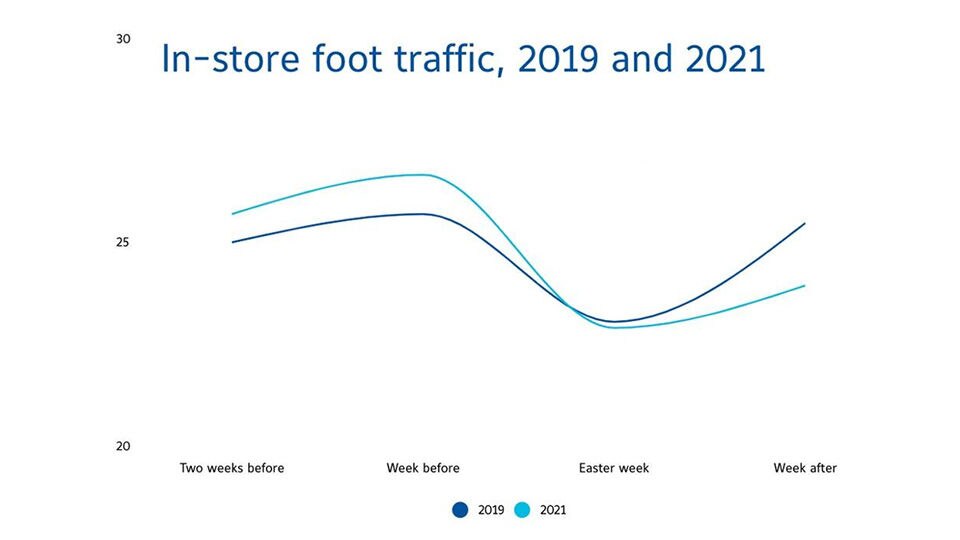

"Traditionally, traffic trends upward during the week before the actual week of Easter, while Easter week itself is relatively slow," McCall said, "And we don't expect this year to be any different."

Easter week shows significantly less foot traffic, he noted, due to the fact many stores are closed on Easter Sunday, which eliminates the second-busiest shopping day of the week.

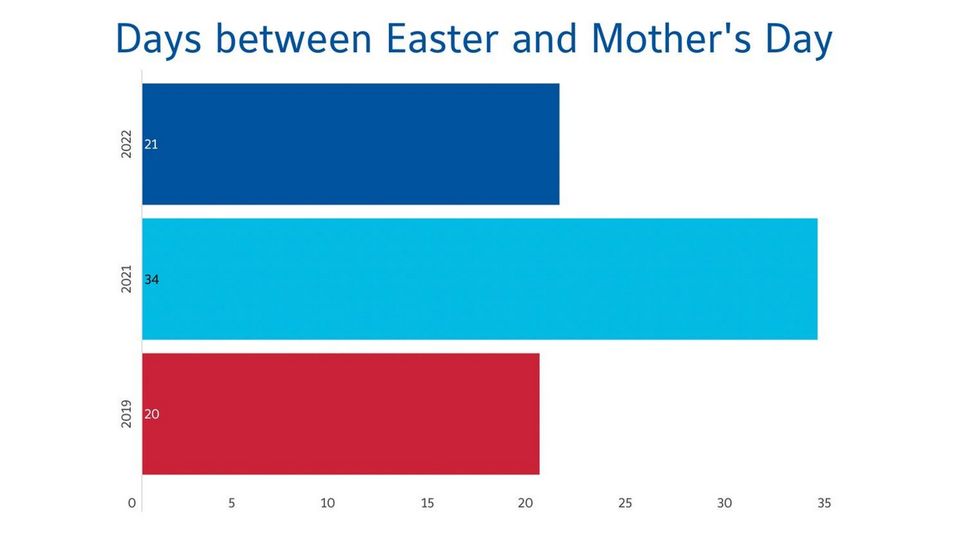

Following Easter, traffic traditionally increases moderately — but this year, like 2019 in the chart below, retailers can expect a more acute boost to in-store traffic than they saw last year.

"The reason for that is this Easter's proximity to Mother's Day," McCall said. "Last year, consumers had more than a month to do their Mother's Day shopping. This year, they have only three weeks, meaning the post-Easter bounce will be bigger and happen sooner."

Takeaways

For retailers, these trends are promising signs and (seemingly) point to a return to almost pre-pandemic levels of Easter shopping activity. But to actually capitalize on them, retailers will need to carefully consider inventory visibility and their ability to predict foot traffic.

"The biggest mistake a CPG retailer could make this Easter is finding themselves with the inability to stay replenished before the holiday starts," McCall stressed. "Just like Halloween, as soon as the event is over, you're going to be marking down seasonal items by 50% and then 75%. If you don't have visibility into your foot traffic, you could potentially order too many seasonal products — and then you're going to lose significant margin on what goes unsold during Easter."

Conversely, not having enough seasonal inventory — or having it in the wrong place — can be equally costly.

"A retailer's window to move seasonal products or even non-seasonal items that traditionally sell well during Easter is very slim," he added. "So if their chocolate bunnies or pastel onesies are in the back of the stockroom, rather than well merchandised out front, that's inventory you're going to take a significant loss on."

For retailers with the right solutions for inventory intelligence and traffic analytics, on the other hand, McCall stressed that this Easter could be very profitable indeed.

"We may not see a complete return to the Easters we knew before the pandemic, but it's going to be close," he said. "And that should be music to every retailer's ears."

Want to learn more? Get in Touch

About Pete McCall

Pete McCall leads the Retail Consulting Practice for the Americas and EMEA regions at Sensormatic Solutions. He and his team partner with retailers and property operators alike to identify sales and profit focused opportunities. Before joining Sensormatic Solutions, Pete held a variety of store and district leadership roles for Macy’s during his 20-plus year tenure.

Explore Related Topics