Article

Prime Day’s Impact on Brick-and-Mortar: Explaining the Unexpected

Prime Day continues to set revenue records, but it isn’t impacting brick-and-mortar stores quite how you might think.

Amazon’s latest Prime Day event generated an estimated $11.2 billion in revenue for the e-commerce giant, a fact that’s unlikely to surprise anyone who keeps even a casual eye on the industry. But with so many consumer dollars flowing into Amazon’s coffers, traditional brick-and-mortar retailers must be feeling the pinch, right?

Not so fast. In fact, not only does Prime Day have virtually no effect on traditional retailers’ foot traffic, some savvy retailers have found ways to boost their sales in Prime Day’s wake.

Let’s break down how Prime Day does — and does not — impact traditional retailers and what lessons brick-and-mortar can learn from e-commerce’s biggest shopping event of the year.

Prime Day 2021: by the numbers

Prime Day 2021 was projected to be the biggest yet, netting Amazon almost $12 billion in sales, according to an estimate from eMarketer.com. However, it didn’t quite hit that mark. As noted above, Digital Commerce 360 estimates that the e-commerce giant pulled in just short of $11.2 billion during the two-day event, and while that’s no small thing, it represents just 7.6% growth over 2020.

That’s the slowest growth Prime Day has experienced since its inception. In fact, prior to this year’s event, revenues increased between 44% and 75% each year. But even with limited growth, Prime Day 2021 can teach retailers two valuable lessons.

Shoppers will buy for back-to-school earlier if given the right incentive

Conventional wisdom in retail dictates that back-to-school (BTS) shopping doesn’t start until mid-July in most cases, but our own research showed that with the right offer in place, parents will prep for the coming school year sooner than traditionally thought.

A Sensormatic Solutions survey of BTS shoppers found that an overwhelming 78% did shop on Prime Day, and 40% said BTS was their primary motivation for doing so.

Consumers will shop in-store for the right product at the right price

With the exception of July 4 Independence Day observance, the period after Father’s Day until the end of summer is traditionally slower for retailers. However, some retailers did experience a sudden surge in foot traffic during Prime Week.

Data from Unacast, our location data services partner, found that Target, which ran a competing promotion starting a day before Prime Day, saw a 13.9% spike in foot traffic. In other words, brick-and-mortar retailers can indeed attract shoppers during Prime Week — if they offer competitive discounts on popular products.

“Instead of taking shoppers out of stores, Prime Day creates e-commerce shoppers where few would ordinarily exist.”

– Pete McCall, senior manager, retail consulting practice at Sensormatic Solutions

Prime Day’s impact — or lack thereof — on brick- and-mortar

Did the uptick in e-commerce spending during Prime Day take revenue away from brick-and-mortar shops? Can other e-commerce vendors hope to keep pace with an event of its magnitude? Is Amazon going to eat every other retailer’s lunch eventually?

The answers to those questions are, in order: probably not, yes, and not if they have the right strategies in place. Let’s dig in.

Prime Day doesn’t keep shoppers out of stores

Prime Day may be the year’s biggest event in e-commerce, but surprisingly, it’s had virtually no effect on brick and mortar shopper traffic.

Take Prime Day 2018, for instance. The event hauled in $4.2 billion, a 75% increase over the preceding year — the event’s largest YoY growth to date. But remarkably, traditional retailers actually saw a 0.4% increase in store traffic during the week of Prime Day 2018.

In other words, Prime Day isn’t keeping shoppers out of physical stores, nor is it sending shoppers to their local retailers in droves. When it comes to actual store traffic, it turns out that Prime Day doesn’t really do anything at all.

Why? Because it’s impossible to steal that which does not exist in the first place. To put it another way, Prime Day isn’t convincing shoppers who would otherwise be in stores to stay home and shop digitally because there are comparatively few in-store shoppers during Prime Day to begin with. Mondays make up just 12% of stores’ total weekly foot traffic, and Tuesdays account for just 11%.

But there’s another interesting fact in play here: According to 2021 data from SaleCycle, Mondays and Tuesdays historically trail every other weekday in terms of online sales. So, if people aren’t shopping in stores or online early in the week, why would Amazon choose those days to launch their biggest retail event?

Because even though comparatively few people are shopping online at the start of the week, those who are, are much more likely to convert.

The same report from SaleCycle found that e-commerce conversion rates are highest at the start of the week and taper off as the week goes on. It’s hardly a stretch to imagine that Amazon’s internal conversion metrics show the same thing, hence the strategic decision to launch Prime Day on a Monday.

Perhaps that’s the real miracle of Prime Day: Instead of taking shoppers out of stores, it’s creating e-commerce shoppers where few existed in the past.

“The growth of Prime Day has had virtually no effect on brick-and-mortar.”

– Pete McCall, senior manager, retail consulting practice at Sensormatic Solutions

As Prime Day thrives, competitors close in

While Prime Day 2021 may have slowed down a bit, there are also three major signs that suggest competitors are finding ways to leverage the event to their advantage.

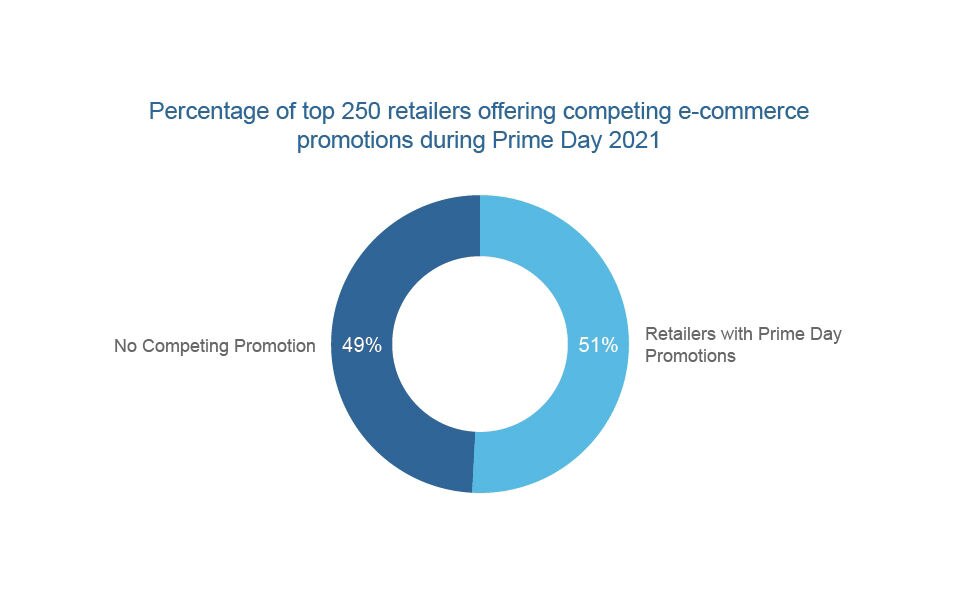

- Growth of competing offers: According to Digital Commerce 360, just over half (51%) of the top 250 retailers ran competing e-commerce promotions during the most recent Prime Day.

- Amazon’s notable loss in traffic share during Prime Day: In 2019, among the top 100 retailers, Amazon accounted for 49% of all e-commerce site traffic during Prime Day. By 2020, that number fell to 41%. While it’s no small thing for a single retailer to still account for four out of every 10 visitors, it’s also a sure sign that competitors are successfully luring shoppers in during Prime Day.

- Amazon’s increased reliance on its own products: Prime Day sales of “marketplace products” — non-Amazon branded products sold on the platform by third parties — have fallen 13% since 2015. In fact, by 2020, sales of Amazon’s own products accounted for 65% of all Prime Day sales.

In sum, Prime Day is still generating massive revenue, but it’s also largely becoming a fire sale for Amazon’s own products. Consumers looking for products from other brands, meanwhile, have an increasingly wide array of choices from competing retailers.

“With accurate forecasting and the right inventory management solution in place, brick-and-mortar retailers can capitalize on Prime Day.”

– Pete McCall, senior manager, retail consulting practice at Sensormatic Solutions

How brick-and-mortar can compete with the next Prime Day

Amazon’s ability to create shoppers and generate revenue on what are typically two of the slowest shopping days of the week during one of the slowest in-store shopping weeks of the summer is admittedly remarkable, but brick and mortar can definitely still compete — if they can achieve a level of item-level tracking that’s, well, Amazonian.

Consider the consumer experience on Amazon during Prime Day (or any other day): Consumers are able to find what they’re looking for using a simple, intuitive search function. They can see if the item they want is in stock or not, and if it is, they can purchase with a few clicks. Then they see transparent shipping options that tell them exactly when they can expect to receive their purchases. There’s very little room here for a poor customer experience.

To compete, brick-and-mortar retailers will have to replicate that same degree of simplicity, speed, and, most notably, inventory accuracy — all of which is much easier said than done. The normalization of BOPAC (buy online, pickup curbside) and BOPIS (buy online, pick up in-store) mean brick-and-mortar retailers will need to have Amazon-like levels of inventory accuracy in each and every store, something relatively few have at the moment.

Imagine the negative customer experience and resulting loss of revenue that would come from customers being told an item is in stock and available for pick up at their local store, only to find out that it’s either out of stock or that retail workers simply can’t find it.

But given how prevalent that scenario is, you probably don’t have to imagine it — you’ve likely experienced it already. You may have written it off as a hiccup, but it almost certainly wasn’t. To understand the potential upside of fixing this gap for retailers, consider the following statistics:

- A recent white paper by IHL estimates that most retailer’s physical inventories are off by as much as 15% to 25% due to shrinkage and blind spots in their supply chains.

- That same report also notes that a retailer loses 5.5 margin points on average for every store visit when their BOPIS systems aren’t optimized.

For retailers looking to compete with Prime Day, these are sobering statistics indeed. But they carry a kernel of good news, too: with accurate forecasting and the right inventory management solution in place, brick-and-mortar can capitalize on Prime Day shopping. Replicating Amazon’s item-level accuracy is entirely achievable — and with the right partners and the right strategies in place, retailers can have it in place well in advance of Prime Day 2022.